Search

Close

Free Trial

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Alteryx Designer Desktop Knowledge Base

Definitive answers from Designer Desktop experts.- Community

- :

- Community

- :

- Support

- :

- Knowledge

- :

- Designer Desktop

- :

- How to use the ETS tool

How to use the ETS tool

Article Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Notify Moderator

Alteryx

Created

on

12-04-2020

07:56 AM

- edited on

07-09-2021

12:17 PM

by

bpatel

How to use the ETS Tool

An ETS model, otherwise known as exponential smoothing, estimates single variable forecasts using weighted averages of past observations. There is more weight given to recent observations with a gradual and constant rate of decrease for the observation weight over time. Depending on the method used, there is a smoothing equation for one or more of the following: level, trend, and seasonality.

Procedure

Start with a Time Series Decomposition Plot from the TS Plot Tool

Use the TS Plot Tool first to determine what options are best in the ETS Tool with the data. Start with the decomposition plot to investigate the seasonality, trend, and error (remainder) terms of a time series. The TS Plot Tool provides the following plots: Time Series, Season, Decomposition, Autocorrelation, and Partial Autocorrelation. For more information, please see https://help.alteryx.com/current/designer/ts-plot-tool.

Determine the method needed for the ETS terms

The E, T, and S terms represent Error, Trend, and Seasonality. The ETS terms will have the letter of the method used.

A = additive

M = multiplicative

N = none

For example, the model ETS(A,M,N) uses an additive method for the error term, a multiplicative method for the trend, and none for the seasonality.

Typically, the additive method is for trend and seasonal variation that remains mostly constant over time (linear). This method adds the difference in prior observations to predict future values.

Multiplication of the terms is best when the trend and seasonal variation increases or decreases exponentially. The method multiplies previous observations by a factor to determine future values.

Over forecasting of results due to a predicted constant future trend can be prevented using a trend damping method. After using trend dampening, you can compare the forecasting errors between the dampened version and the original to determine which one is more accurate.

Build and validate the ETS model

Commonly, 10 - 30% of the data is used for a holdout validation sample in predictive modeling. This sample is usually the most recent data. It should include at least the number of periods you are forecasting. Validate with the TS Compare Tool using the ETS tool’s Object output and the remaining data.

When the Auto option is selected on the Model Type tab, the ETS tool automatically chooses the best model terms based on the AIC score. When comparing a custom model to auto selections, if the AIC scores are similar, and compare the calculated errors to see what is best.

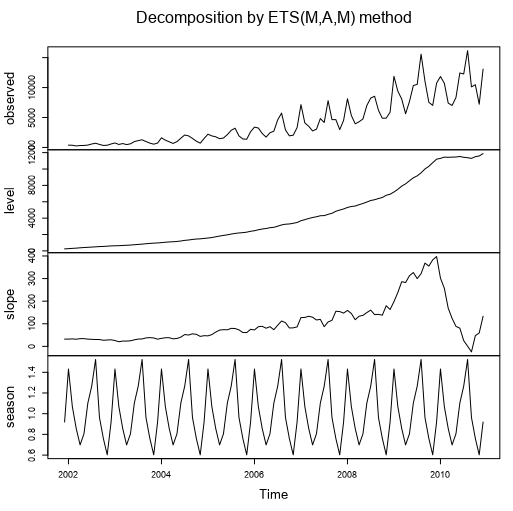

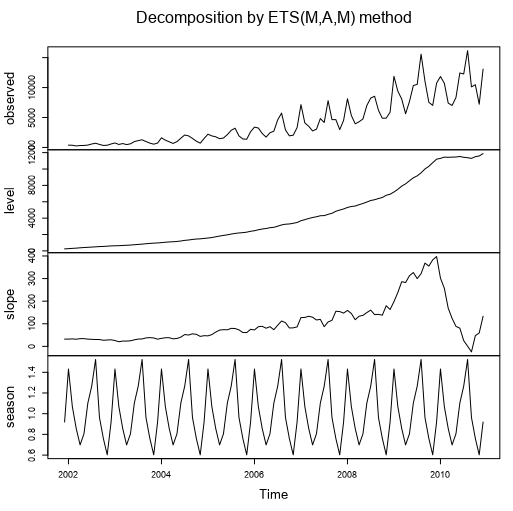

In the model output from the ETS Tool four different decomposition graphs display:

Observed: The actual data

Level: Baseline of data without seasonality

Slope: Rate of change associated with the level

Seasonality: Cyclical effects due to time of year

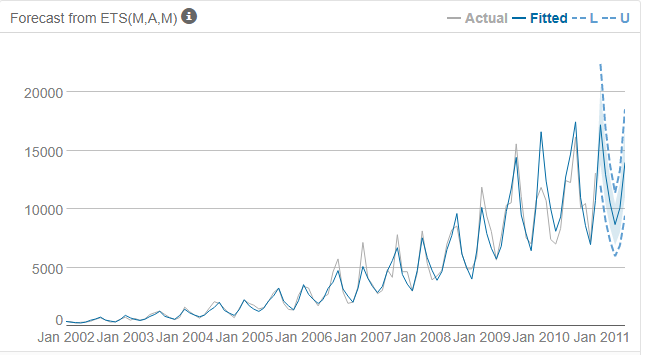

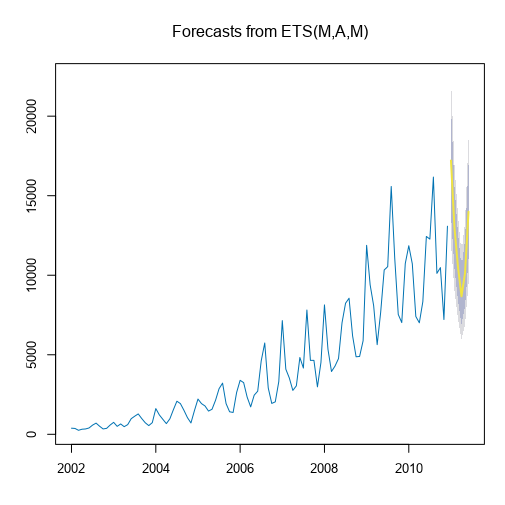

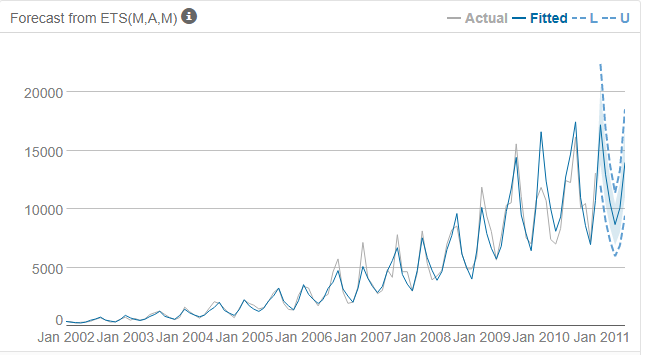

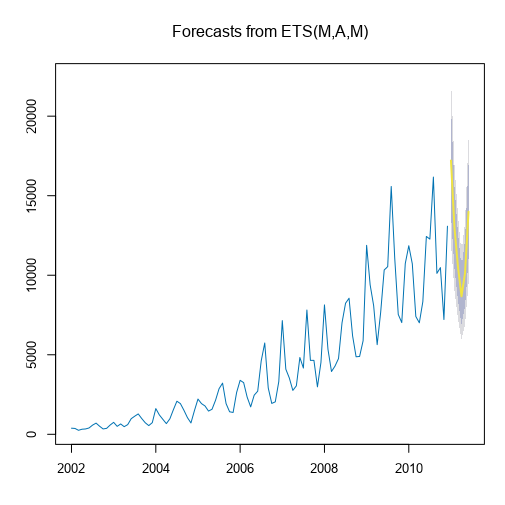

Example forecasts from the ETS model

These graphs shows historical data and future forecasts within a 90% and 95% confidence interval. You can highlight an area of the forecasted plot to zoom into that area.

Here is an example method from the report output (R anchor). It has multiplicative error terms, additive trend terms, and multiplicative seasonality terms.

A = additive

M = multiplicative

N = none

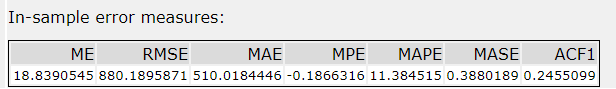

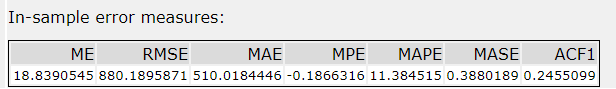

In-Sample Error Measures

Lower errors show a better model.

ME: Mean Error is the average difference of actual and forecasted values.

RMSE: Root Mean Square Error is the standard deviation for the differences between forecasted values and actual values.

MAE: Mean Absolute Error is the average sum of the difference from actual to forecasted values.

MPE: Mean Percent Error is the average percent difference between actual and forecasted values.

MAPE: Mean Absolute Percent Error is expressed in a percentage that is useful for reporting.

MASE: Mean Absolute Scaled Error is the mean absolute error of the model divided by the the mean absolute value of the first difference of the series.

Scale-dependent errors are only for use with a single time series scale, and cannot be used with other comparisons on a different scale. This includes the measures ME, MPE, MAE, and RMSE.

Percentage Errors are scale-independent and can be used for comparing forecast between different time series data sets, for example MAPE. Scale-free errors are also scale-independent such as MASE.

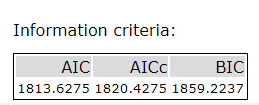

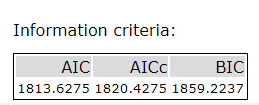

Information Criteria

Lowest values show the best fit.

AIC: Akaike Info. Criterion This measure shows the comparative quality of a statistical model. It balances the goodness of fit with the complexity of the model. AIC is used for comparison of models produced from the same data. AIC cannot show that all models are too inaccurate. It only provides a comparison of the accuracy between the models.

AICc: Akaike Info. Criterion Corrected If the auto option (default configuration) is selected, then the AICc is used if there are 48 or fewer observations

BIC: Bayesian Info. Criterion

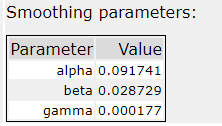

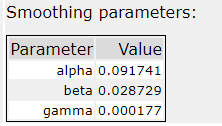

Smoothing Parameters

Alpha: Shows percent of forecasts that are based on the most recent observations. It represents the level of the data.

Beta: Parameter for exponential decay. Usually between 0 and 1. The closer to 1 the higher the weight on more recent observations. It represents the trend of the data.

Gamma: The higher the gamma, the more weight is placed on more recent observations. It represents seasonality of the data. Seasonality increases in proportion to level.

Small values of beta and gamma result in very small changes over time for slope and seasonality.

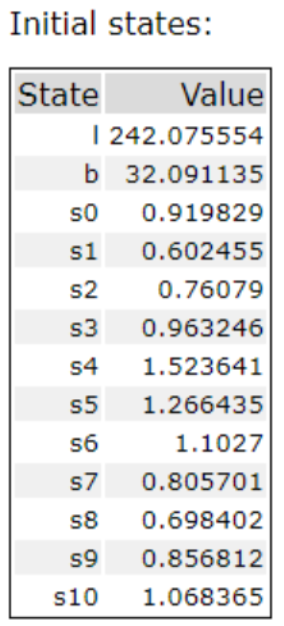

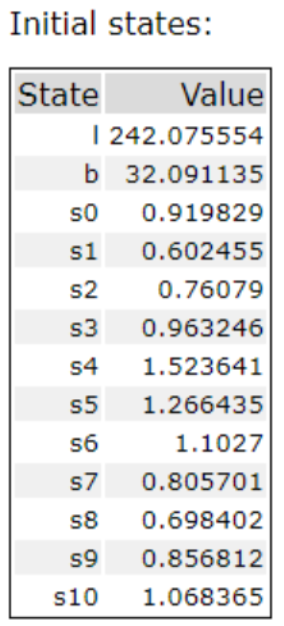

Initial States

Estimates used to calculate AIC.

Which model is the best, ARIMA or ETS? Try both and use the TS Compare tool. It selects the model with the best AIC or AICc score.

For information on how to use the ARIMA tool, please see: https://community.alteryx.com/t5/Alteryx-Designer-Knowledge-Base/How-to-use-the-ARIMA-tool/ta-p/5496....

Forecast

Based on the validation testing, use the best model in the TS Forecast tool. Before using this tool, add the validation sample back to the data set. Note: you can highlight an area of a forecasted plot in the TS Forecast tool to zoom into that area.

A residual is a difference between the observed value and the forecasted value. Good forecasting shows uncorrelated residuals. Residuals should be close to a 0 mean. Otherwise, the forecasts will be inaccurate. If needed, add the mean to all of the forecasts to correct this issue.

After installing the Predictive Tools, Sample Time Series workflows are available in Help, Sample Workflows, Predictive tool samples menu. There are help pages for the Time Series tools, as well as recorded training sessions. Also, there is a free Time Series Forecasting course on the alteryx.com Resources page. Please see the links below.

Credit and thanks goes to Bhumika Patel for the idea to write the article and much of the content.

Additional Resources

https://help.alteryx.com/current/designer/time-series

https://community.alteryx.com/t5/Videos/Time-Series-Analysis/td-p/114070

https://community.alteryx.com/t5/Videos/Time-Series-Modeling/td-p/256421

https://www.alteryx.com/resources/resource-library/predictive-training

An ETS model, otherwise known as exponential smoothing, estimates single variable forecasts using weighted averages of past observations. There is more weight given to recent observations with a gradual and constant rate of decrease for the observation weight over time. Depending on the method used, there is a smoothing equation for one or more of the following: level, trend, and seasonality.

Procedure

Start with a Time Series Decomposition Plot from the TS Plot Tool

Use the TS Plot Tool first to determine what options are best in the ETS Tool with the data. Start with the decomposition plot to investigate the seasonality, trend, and error (remainder) terms of a time series. The TS Plot Tool provides the following plots: Time Series, Season, Decomposition, Autocorrelation, and Partial Autocorrelation. For more information, please see https://help.alteryx.com/current/designer/ts-plot-tool.

Determine the method needed for the ETS terms

The E, T, and S terms represent Error, Trend, and Seasonality. The ETS terms will have the letter of the method used.

A = additive

M = multiplicative

N = none

For example, the model ETS(A,M,N) uses an additive method for the error term, a multiplicative method for the trend, and none for the seasonality.

Typically, the additive method is for trend and seasonal variation that remains mostly constant over time (linear). This method adds the difference in prior observations to predict future values.

Multiplication of the terms is best when the trend and seasonal variation increases or decreases exponentially. The method multiplies previous observations by a factor to determine future values.

Over forecasting of results due to a predicted constant future trend can be prevented using a trend damping method. After using trend dampening, you can compare the forecasting errors between the dampened version and the original to determine which one is more accurate.

Build and validate the ETS model

Commonly, 10 - 30% of the data is used for a holdout validation sample in predictive modeling. This sample is usually the most recent data. It should include at least the number of periods you are forecasting. Validate with the TS Compare Tool using the ETS tool’s Object output and the remaining data.

When the Auto option is selected on the Model Type tab, the ETS tool automatically chooses the best model terms based on the AIC score. When comparing a custom model to auto selections, if the AIC scores are similar, and compare the calculated errors to see what is best.

In the model output from the ETS Tool four different decomposition graphs display:

Observed: The actual data

Level: Baseline of data without seasonality

Slope: Rate of change associated with the level

Seasonality: Cyclical effects due to time of year

Example forecasts from the ETS model

These graphs shows historical data and future forecasts within a 90% and 95% confidence interval. You can highlight an area of the forecasted plot to zoom into that area.

Here is an example method from the report output (R anchor). It has multiplicative error terms, additive trend terms, and multiplicative seasonality terms.

A = additive

M = multiplicative

N = none

In-Sample Error Measures

Lower errors show a better model.

ME: Mean Error is the average difference of actual and forecasted values.

RMSE: Root Mean Square Error is the standard deviation for the differences between forecasted values and actual values.

MAE: Mean Absolute Error is the average sum of the difference from actual to forecasted values.

MPE: Mean Percent Error is the average percent difference between actual and forecasted values.

MAPE: Mean Absolute Percent Error is expressed in a percentage that is useful for reporting.

MASE: Mean Absolute Scaled Error is the mean absolute error of the model divided by the the mean absolute value of the first difference of the series.

Scale-dependent errors are only for use with a single time series scale, and cannot be used with other comparisons on a different scale. This includes the measures ME, MPE, MAE, and RMSE.

Percentage Errors are scale-independent and can be used for comparing forecast between different time series data sets, for example MAPE. Scale-free errors are also scale-independent such as MASE.

Information Criteria

Lowest values show the best fit.

AIC: Akaike Info. Criterion This measure shows the comparative quality of a statistical model. It balances the goodness of fit with the complexity of the model. AIC is used for comparison of models produced from the same data. AIC cannot show that all models are too inaccurate. It only provides a comparison of the accuracy between the models.

AICc: Akaike Info. Criterion Corrected If the auto option (default configuration) is selected, then the AICc is used if there are 48 or fewer observations

BIC: Bayesian Info. Criterion

Smoothing Parameters

Alpha: Shows percent of forecasts that are based on the most recent observations. It represents the level of the data.

Beta: Parameter for exponential decay. Usually between 0 and 1. The closer to 1 the higher the weight on more recent observations. It represents the trend of the data.

Gamma: The higher the gamma, the more weight is placed on more recent observations. It represents seasonality of the data. Seasonality increases in proportion to level.

Small values of beta and gamma result in very small changes over time for slope and seasonality.

Initial States

Estimates used to calculate AIC.

Which model is the best, ARIMA or ETS? Try both and use the TS Compare tool. It selects the model with the best AIC or AICc score.

For information on how to use the ARIMA tool, please see: https://community.alteryx.com/t5/Alteryx-Designer-Knowledge-Base/How-to-use-the-ARIMA-tool/ta-p/5496....

Forecast

Based on the validation testing, use the best model in the TS Forecast tool. Before using this tool, add the validation sample back to the data set. Note: you can highlight an area of a forecasted plot in the TS Forecast tool to zoom into that area.

A residual is a difference between the observed value and the forecasted value. Good forecasting shows uncorrelated residuals. Residuals should be close to a 0 mean. Otherwise, the forecasts will be inaccurate. If needed, add the mean to all of the forecasts to correct this issue.

After installing the Predictive Tools, Sample Time Series workflows are available in Help, Sample Workflows, Predictive tool samples menu. There are help pages for the Time Series tools, as well as recorded training sessions. Also, there is a free Time Series Forecasting course on the alteryx.com Resources page. Please see the links below.

Credit and thanks goes to Bhumika Patel for the idea to write the article and much of the content.

Additional Resources

https://help.alteryx.com/current/designer/time-series

https://community.alteryx.com/t5/Videos/Time-Series-Analysis/td-p/114070

https://community.alteryx.com/t5/Videos/Time-Series-Modeling/td-p/256421

https://www.alteryx.com/resources/resource-library/predictive-training

Labels:

Labels

-

2018.3

17 -

2018.4

13 -

2019.1

18 -

2019.2

7 -

2019.3

9 -

2019.4

13 -

2020.1

22 -

2020.2

30 -

2020.3

29 -

2020.4

35 -

2021.2

52 -

2021.3

25 -

2021.4

38 -

2022.1

33 -

Alteryx Designer

9 -

Alteryx Gallery

1 -

Alteryx Server

3 -

API

29 -

Apps

40 -

AWS

11 -

Computer Vision

6 -

Configuration

108 -

Connector

136 -

Connectors

1 -

Data Investigation

14 -

Database Connection

196 -

Date Time

30 -

Designer

204 -

Desktop Automation

22 -

Developer

72 -

Documentation

27 -

Dynamic Processing

31 -

Dynamics CRM

5 -

Error

267 -

Excel

52 -

Expression

40 -

FIPS Designer

1 -

FIPS Licensing

1 -

FIPS Supportability

1 -

FTP

4 -

Fuzzy Match

6 -

Gallery Data Connections

5 -

Google

20 -

In-DB

71 -

Input

185 -

Installation

55 -

Interface

25 -

Join

25 -

Licensing

22 -

Logs

4 -

Machine Learning

4 -

Macros

93 -

Oracle

38 -

Output

110 -

Parse

23 -

Power BI

16 -

Predictive

63 -

Preparation

59 -

Prescriptive

6 -

Python

68 -

R

39 -

RegEx

14 -

Reporting

53 -

Run Command

24 -

Salesforce

25 -

Setup & Installation

1 -

Sharepoint

17 -

Spatial

53 -

SQL

48 -

Tableau

25 -

Text Mining

2 -

Tips + Tricks

94 -

Transformation

15 -

Troubleshooting

3 -

Visualytics

1

- « Previous

- Next »