Alteryx Designer Desktop Discussions

Find answers, ask questions, and share expertise about Alteryx Designer Desktop and Intelligence Suite.- Community

- :

- Community

- :

- Participate

- :

- Discussions

- :

- Designer Desktop

- :

- Re: Closing balance of a row needs to move in nex...

Closing balance of a row needs to move in next as opening balance

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Hi all,

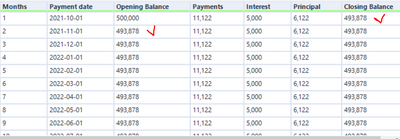

I am building a loan repayment schedule and trying to update Opening Balance as Closing Balance of last row. It's working for the second row only. Additionally, there is no change on the amount of Interest in second row, as Opening Balance is reduced. Someone please help me on the missing part of the formula.

Solved! Go to Solution.

- Labels:

-

Tips and Tricks

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Hi @Kamran1991 ,

Since your payment and interest columns depend on the opening balance which changes for each month, a simple multi-row formula tool won't take you where you are looking to go, because for your second row your payments and interest will be different than in the first row.

To solve this problem, you probably have to create an iterative macro that will yield the correct result for you. I'm sure there should be a similar post in the community that uses a similar iterative macro.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Hi @AngelosPachis,

thanks for your reply.

Can you help me to find this solution means iterative macro for it ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

@Kamran1991 I had this post in mind but then I realised it's quite complex for your use case

If you are not familiar with macros I would suggest first going through this interactive lesson of the Academy

https://community.alteryx.com/t5/Interactive-Lessons/tkb-p/interactive-lessons/label-name/Macros

I have created a workflow for you that probably answers your question

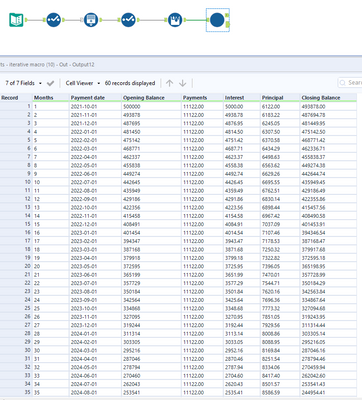

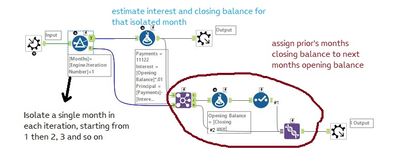

The iterative macro will isolate each record one by one, starting from month number 1, estimating the interest and principal and then finding the closing balance for that month.

It will then go to the next month, and replace the opening balance with the closing balance of the prior month and pass the data through the macro on the next iteration. On the second iteration, month number 2 will be isolated, the interest and principal will be recalculated based on the new opening balance values and a new closing balance will be estimated for that month. Then again, the closing balance for month #2 will become the opening balance for month #3 and the next iteration will start and so on, until you don't have any more months in the data you are feeding the macro.

In the formula tool, there are also quite a few Finance formulas that might have come in handy but personally I'm not very familiar with them. But if you are in the world of Finance, then it might be worth having a look at them.

Cheers,

Angelos

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Hi @AngelosPachis,

Thanks for your help. It is a little difficult to understand for beginners but your post is helpful.

-

AAH

1 -

AAH Welcome

2 -

Academy

24 -

ADAPT

82 -

Add column

1 -

Administration

20 -

Adobe

177 -

Advanced Analytics

1 -

Advent of Code

5 -

Alias Manager

70 -

Alteryx

1 -

Alteryx 2020.1

3 -

Alteryx Academy

3 -

Alteryx Analytics

1 -

Alteryx Analytics Hub

2 -

Alteryx Community Introduction - MSA student at CSUF

1 -

Alteryx Connect

1 -

Alteryx Designer

44 -

Alteryx Engine

1 -

Alteryx Gallery

1 -

Alteryx Hub

1 -

alteryx open source

1 -

Alteryx Post response

1 -

Alteryx Practice

134 -

Alteryx team

1 -

Alteryx Tools

1 -

AlteryxForGood

1 -

Amazon s3

138 -

AMP Engine

191 -

ANALYSTE INNOVATEUR

1 -

Analytic App Support

1 -

Analytic Apps

17 -

Analytic Apps ACT

1 -

Analytics

2 -

Analyzer

17 -

Announcement

4 -

API

1,043 -

App

1 -

App Builder

43 -

Append Fields

1 -

Apps

1,168 -

Archiving process

1 -

ARIMA

1 -

Assigning metadata to CSV

1 -

Authentication

4 -

Automatic Update

1 -

Automating

3 -

Banking

1 -

Base64Encoding

1 -

Basic Table Reporting

1 -

Batch Macro

1,276 -

Beginner

1 -

Behavior Analysis

219 -

Best Practices

2,418 -

BI + Analytics + Data Science

1 -

Book Worm

2 -

Bug

624 -

Bugs & Issues

2 -

Calgary

59 -

CASS

46 -

Cat Person

1 -

Category Documentation

1 -

Category Input Output

2 -

Certification

4 -

Chained App

235 -

Challenge

7 -

Charting

1 -

Clients

3 -

Clustering

1 -

Common Use Cases

3,394 -

Communications

1 -

Community

188 -

Computer Vision

46 -

Concatenate

1 -

Conditional Column

1 -

Conditional statement

1 -

CONNECT AND SOLVE

1 -

Connecting

6 -

Connectors

1,186 -

Content Management

8 -

Contest

6 -

Conversation Starter

17 -

copy

1 -

COVID-19

4 -

Create a new spreadsheet by using exising data set

1 -

Credential Management

3 -

Curious*Little

1 -

Custom Formula Function

1 -

Custom Tools

1,726 -

Dash Board Creation

1 -

Data Analyse

1 -

Data Analysis

2 -

Data Analytics

1 -

Data Challenge

83 -

Data Cleansing

4 -

Data Connection

1 -

Data Investigation

3,069 -

Data Load

1 -

Data Science

38 -

Database Connection

1,900 -

Database Connections

5 -

Datasets

4,591 -

Date

3 -

Date and Time

3 -

date format

2 -

Date selection

2 -

Date Time

2,892 -

Dateformat

1 -

dates

1 -

datetimeparse

2 -

Defect

2 -

Demographic Analysis

173 -

Designer

1 -

Designer Cloud

482 -

Designer Integration

60 -

Developer

3,656 -

Developer Tools

2,929 -

Discussion

2 -

Documentation

455 -

Dog Person

4 -

Download

908 -

Duplicates rows

1 -

Duplicating rows

1 -

Dynamic

1 -

Dynamic Input

1 -

Dynamic Name

1 -

Dynamic Processing

2,545 -

dynamic replace

1 -

dynamically create tables for input files

1 -

Dynamically select column from excel

1 -

Email

745 -

Email Notification

1 -

Email Tool

2 -

Embed

1 -

embedded

1 -

Engine

129 -

Enhancement

3 -

Enhancements

2 -

Error Message

1,982 -

Error Messages

6 -

ETS

1 -

Events

178 -

Excel

1 -

Excel dynamically merge

1 -

Excel Macro

1 -

Excel Users

1 -

Explorer

2 -

Expression

1,700 -

extract data

1 -

Feature Request

1 -

Filter

1 -

filter join

1 -

Financial Services

1 -

Foodie

2 -

Formula

2 -

formula or filter

1 -

Formula Tool

4 -

Formulas

2 -

Fun

4 -

Fuzzy Match

615 -

Fuzzy Matching

1 -

Gallery

591 -

General

93 -

General Suggestion

1 -

Generate Row and Multi-Row Formulas

1 -

Generate Rows

1 -

Getting Started

1 -

Google Analytics

141 -

grouping

1 -

Guidelines

11 -

Hello Everyone !

2 -

Help

4,129 -

How do I colour fields in a row based on a value in another column

1 -

How-To

1 -

Hub 20.4

2 -

I am new to Alteryx.

1 -

identifier

1 -

In Database

856 -

In-Database

1 -

Input

3,723 -

Input data

2 -

Inserting New Rows

1 -

Install

3 -

Installation

305 -

Interface

2 -

Interface Tools

1,649 -

Introduction

5 -

Iterative Macro

952 -

Jira connector

1 -

Join

1,740 -

knowledge base

1 -

Licenses

1 -

Licensing

210 -

List Runner

1 -

Loaders

12 -

Loaders SDK

1 -

Location Optimizer

52 -

Lookup

1 -

Machine Learning

230 -

Macro

2 -

Macros

2,506 -

Mapping

1 -

Marketo

12 -

Marketplace

4 -

matching

1 -

Merging

1 -

MongoDB

66 -

Multiple variable creation

1 -

MultiRowFormula

1 -

Need assistance

1 -

need help :How find a specific string in the all the column of excel and return that clmn

1 -

Need help on Formula Tool

1 -

network

1 -

News

1 -

None of your Business

1 -

Numeric values not appearing

1 -

ODBC

1 -

Off-Topic

14 -

Office of Finance

1 -

Oil & Gas

1 -

Optimization

649 -

Output

4,518 -

Output Data

1 -

package

1 -

Parse

2,104 -

Pattern Matching

1 -

People Person

6 -

percentiles

1 -

Power BI

197 -

practice exercises

1 -

Predictive

2 -

Predictive Analysis

823 -

Predictive Analytics

1 -

Preparation

4,644 -

Prescriptive Analytics

186 -

Publish

230 -

Publishing

2 -

Python

731 -

Qlik

36 -

quartiles

1 -

query editor

1 -

Question

18 -

Questions

1 -

R Tool

453 -

refresh issue

1 -

RegEx

2,112 -

Remove column

1 -

Reporting

2,119 -

Resource

15 -

RestAPI

1 -

Role Management

3 -

Run Command

501 -

Run Workflows

10 -

Runtime

1 -

Salesforce

244 -

Sampling

1 -

Schedule Workflows

3 -

Scheduler

372 -

Scientist

1 -

Search

3 -

Search Feedback

20 -

Server

525 -

Settings

759 -

Setup & Configuration

47 -

Sharepoint

466 -

Sharing

2 -

Sharing & Reuse

1 -

Snowflake

1 -

Spatial

1 -

Spatial Analysis

559 -

Student

9 -

Styling Issue

1 -

Subtotal

1 -

System Administration

1 -

Tableau

462 -

Tables

1 -

Technology

1 -

Text Mining

414 -

Thumbnail

1 -

Thursday Thought

10 -

Time Series

397 -

Time Series Forecasting

1 -

Tips and Tricks

3,787 -

Tool Improvement

1 -

Topic of Interest

40 -

Transformation

3,226 -

Transforming

3 -

Transpose

1 -

Truncating number from a string

1 -

Twitter

24 -

Udacity

85 -

Unique

2 -

Unsure on approach

1 -

Update

1 -

Updates

2 -

Upgrades

1 -

URL

1 -

Use Cases

1 -

User Interface

21 -

User Management

4 -

Video

2 -

VideoID

1 -

Vlookup

1 -

Weekly Challenge

1 -

Weibull Distribution Weibull.Dist

1 -

Word count

1 -

Workflow

8,493 -

Workflows

1 -

YearFrac

1 -

YouTube

1 -

YTD and QTD

1

- « Previous

- Next »