Alteryx Success Stories

Learn how Alteryx customers transform their organizations using data and analytics.- Community

- :

- Public Archive

- :

- Success Stories

- :

- Predicting Defectors with Alteryx Designer

Predicting Defectors with Alteryx Designer

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Printer Friendly Page

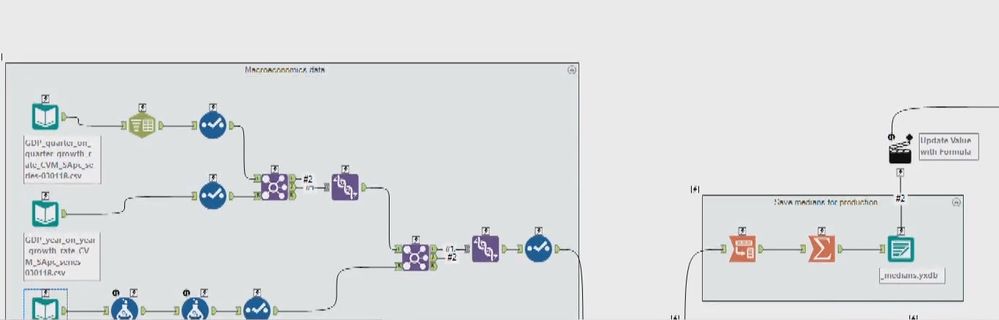

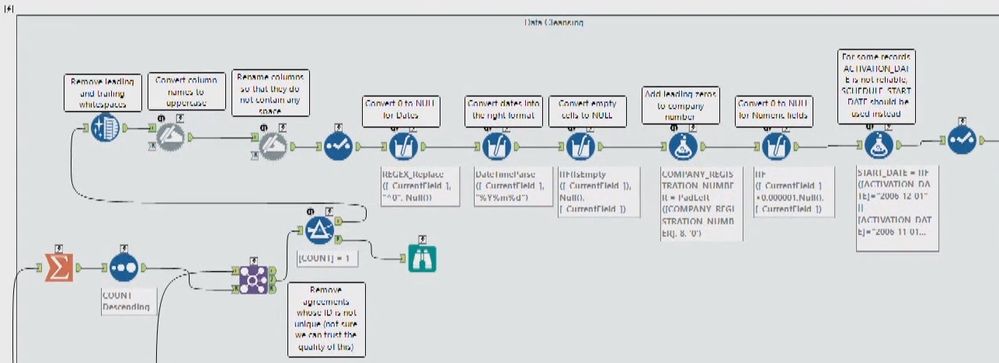

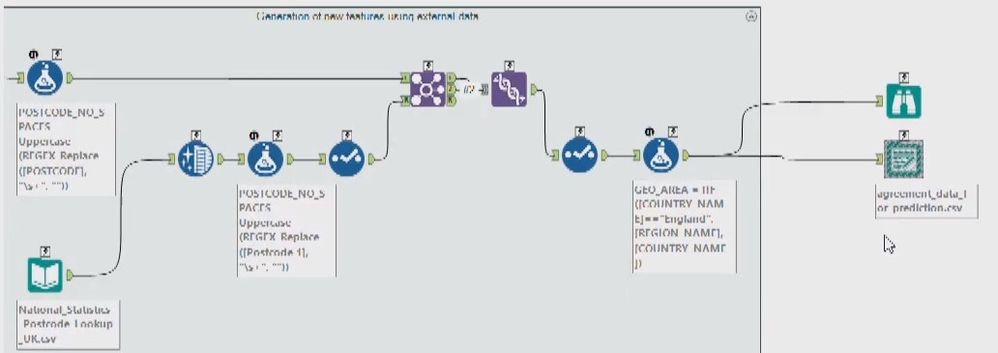

Close Brothers is a leading UK merchant banking group providing lending, deposit taking, wealth management services, and securities trading. In 2016, Close Brothers created their first Alteryx workflow. In 2018, they had 121 Alteryx users and unlimited licenses. Their marketing team uses Alteryx to predict defectors by running targeted marketing campaigns. The work is done on Alteryx from beginning to end, including data access, exploration and cleaning, feature generation, predictive modeling, and model comparison. The final model has been put into production as a day-to-day tool, and the accuracy of the predictive model is 80-90%.

The Marketing team wanted to predict defectors by running targeted marketing campaigns. First, they defined a defector as “a customer that doesn’t pick up a new deal within 24 months of current deal maturity.”

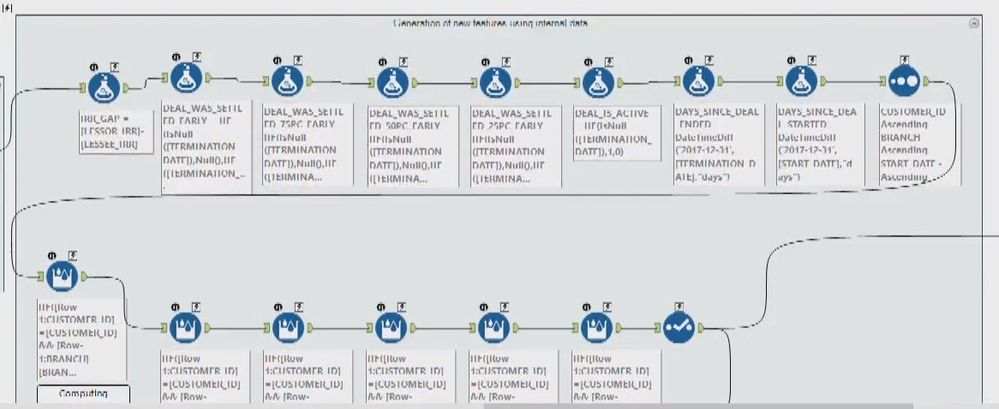

They had 12 years’ worth of data and 4 different business units, and each one had between 4,000 to 10,000 agreements. Each deal had 30 or more variables, such as whether the customer is an early or regular payer, information about the agreement, term, amount, interest rate, and what assets they had financed.

Close Brothers tackled this project in 3 months. “We operate as an internal consultancy within Close Brothers. This project has been trusted to the BI team, and we connect our Alteryx workflows directly to our local database. This is a classification model, so we can get a probability of customers defecting in the next 2 years. It outputs in a CSV in Excel and we send to the marketing agency to run the campaigns,” said Viktor Kazinec.

To build the model, they used 2/3 of training samples and 1/3 of validation samples. They achieved high accuracy rates for predicting defectors (84%-90%) and predicting loyalist (46% - 86%). “Another challenge was how this model would perform on current data. You are building a model in the end of 2017, but you are only using data from 2005 to 2015. So we performed an out of time testing. We used the training samples from 2005 to 2014 and validation from 2014 to 2015,” he said.

- Data cleaning: remove dirty data, duplicates and generate new variables. All the dataset is stored in a SQL server database

- Generate outcome: defectors were not a variable in the database

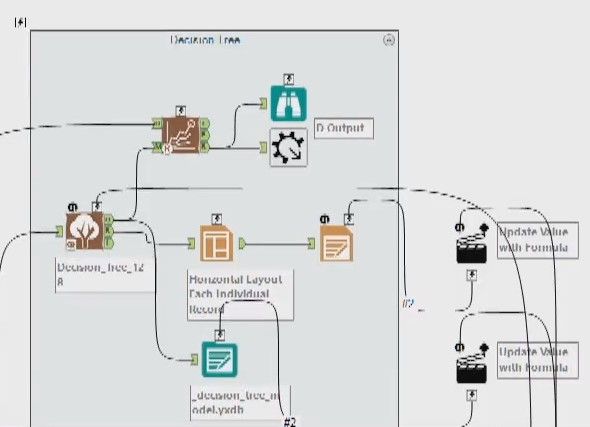

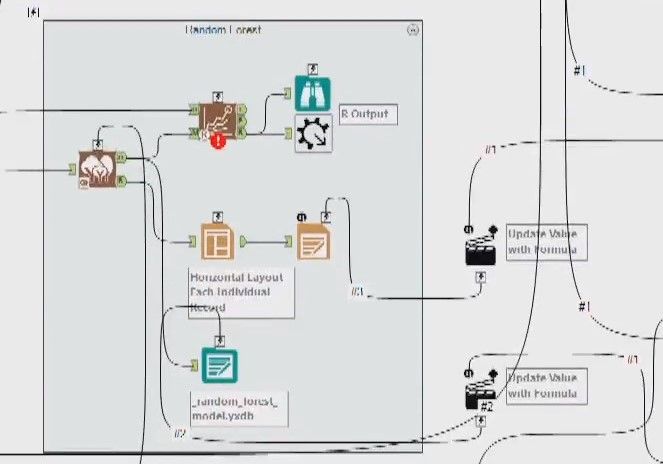

- Predicting future defection: train one model per branch because their customers are different – Decision Tree, Random Forest, Logistic Regression

Describe the benefits you have achieved

Campaign Results

- Triple conversion rate

- 20% higher average deal size

Model Maintenance

- Easy to update every 6-12 months

- Easy to adjust for changes in data, customer type or behavior

Related Resources

-

Adobe

2 -

Alteryx Connect

5 -

Alteryx Designer

202 -

Alteryx for Good

1 -

Alteryx Promote

2 -

Alteryx Server

66 -

Alteryx using Alteryx

29 -

Americas

158 -

Analyst

108 -

Analytics Leader

54 -

Asia Pacific

29 -

AWS

9 -

BI + Analytics + Data Science

100 -

Business Leader

37 -

C-Leader

18 -

Data Prep + Analytics

230 -

Data Science + Machine Learning

113 -

Data Scientist

14 -

Department: Other

14 -

Education

18 -

Energy + Utilities

5 -

Europe + Middle East + Africa

58 -

Experian

2 -

finance

29 -

Financial Services

33 -

Healthcare + Insurance

21 -

Human Resources

19 -

Information Technology

25 -

IT

31 -

Life Sciences + Pharmaceuticals

3 -

Manufacturing

20 -

Marketing

16 -

Media + Entertainment

12 -

Microsoft

52 -

Operations

38 -

Other

10 -

Process Automation

60 -

Professional Services

69 -

Public Sector

15 -

Qlik

1 -

Retail + CPG

32 -

Sales and Service

24 -

Salesforce

9 -

SAP

11 -

Snowflake

6 -

Tableau

71 -

Tech Partner: Other

86 -

Technology

34 -

Telecommunications

5 -

Teradata

5 -

Thomson Reuters

1 -

Transportation + Logistics

25 -

Travel + Hospitality

4 -

UiPath

1

- « Previous

- Next »