Bring your best ideas to the AI Use Case Contest! Enter to win 40 hours of expert engineering support and bring your vision to life using the powerful combination of Alteryx + AI. Learn more now, or go straight to the submission form.

Search

Close

Start Free Trial

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Weekly Challenges

Solve the challenge, share your solution and summit the ranks of our Community!Also available in | Français | Português | Español | 日本語

IDEAS WANTED

Want to get involved? We're always looking for ideas and content for Weekly Challenges.

SUBMIT YOUR IDEA- Community

- :

- Community

- :

- Learn

- :

- Academy

- :

- Challenges & Quests

- :

- Weekly Challenges

- :

- Re: Challenge #362: Capital Gains Tax when Selling...

Challenge #362: Capital Gains Tax when Selling a Home

Options

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

HBenMatouk

5 - Atom

03-21-2023

03:58 AM

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

mattlennie

Alteryx Alumni (Retired)

03-21-2023

06:13 AM

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

RobbieA

8 - Asteroid

03-21-2023

08:49 AM

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

braveraj

11 - Bolide

03-21-2023

11:43 AM

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

lanes1

8 - Asteroid

03-21-2023

05:25 PM

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

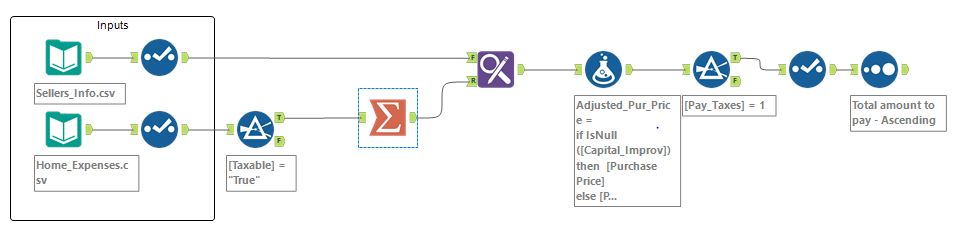

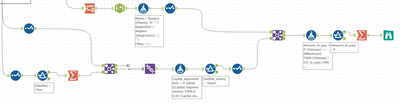

There's definitely ways to do this more efficiently, but this was my stab at it.

tammybrown_tds

9 - Comet

03-21-2023

11:17 PM

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

JamesCharnley

13 - Pulsar

03-22-2023

06:47 AM

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Matching output without extra thought about tax brackets

jrobiso2

8 - Asteroid

03-22-2023

08:41 AM

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

CanalB

8 - Asteroid

03-23-2023

01:59 AM

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Virgile_Haution

7 - Meteor

03-27-2023

08:11 AM

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Labels

-

Advanced

299 -

Apps

27 -

Basic

156 -

Calgary

1 -

Core

155 -

Data Analysis

186 -

Data Cleansing

6 -

Data Investigation

7 -

Data Parsing

15 -

Data Preparation

234 -

Developer

35 -

Difficult

85 -

Expert

16 -

Foundation

13 -

Interface

39 -

Intermediate

266 -

Join

211 -

Macros

61 -

Parse

141 -

Predictive

20 -

Predictive Analysis

14 -

Preparation

272 -

Reporting

55 -

Reporting and Visualization

17 -

Spatial

60 -

Spatial Analysis

53 -

Time Series

1 -

Transform

225

- « Previous

- Next »