Weekly Challenges

Solve the challenge, share your solution and summit the ranks of our Community!Also available in | Français | Português | Español | 日本語

IDEAS WANTED

Want to get involved? We're always looking for ideas and content for Weekly Challenges.

SUBMIT YOUR IDEA- Community

- :

- Community

- :

- Learn

- :

- Academy

- :

- Challenges & Quests

- :

- Weekly Challenges

- :

- Re: Weekly Exercise #24: ARIMA Time Series (Interm...

Challenge #24: ARIMA Time Series

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

For those of you following along, thank you, you can find the solution to last week’s challenge (challenge #23) is HERE.

This week’s challenge will use the predictive time series tool called ARIMA. If you don’t have the predictive tools you can find the installer at http://downloads.alteryx.com/downloads.html look for the link to “Predictive tools only”. The predictive tools in Alteryx execute the analytics in an open source application called ‘R’, the advantage of using Alteryx vs. R is that Alteryx provides a straight-forward user interface and eliminates the need to program directly in the R language. If you want to read more about what is happening under the hood, here is a link to the Wiki on ARIMA. https://en.wikipedia.org/wiki/Autoregressive_integrated_moving_average

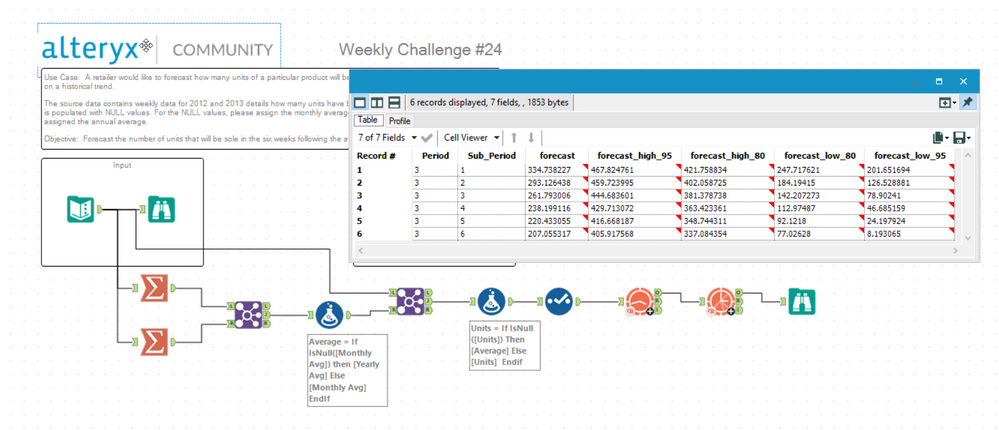

The use case: A retailer would like to forecast how many units of a particular product will be purchased from their locations based on a historical trend.

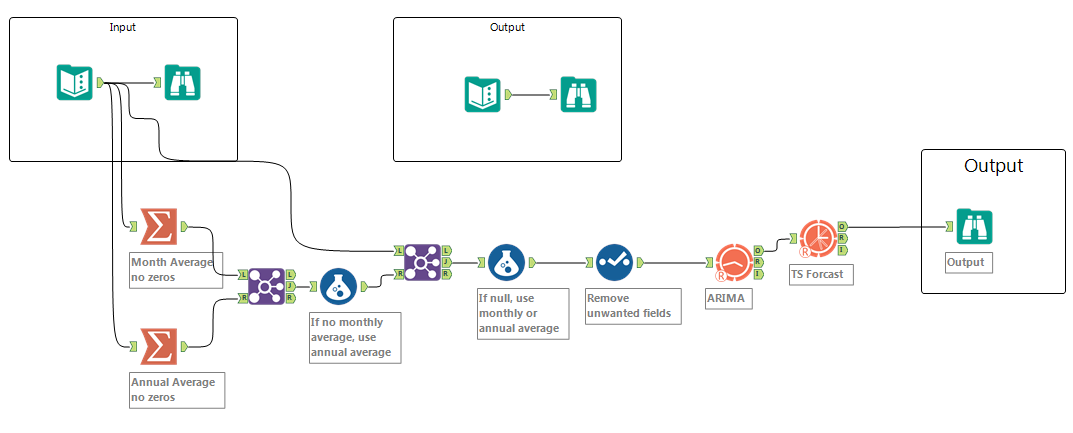

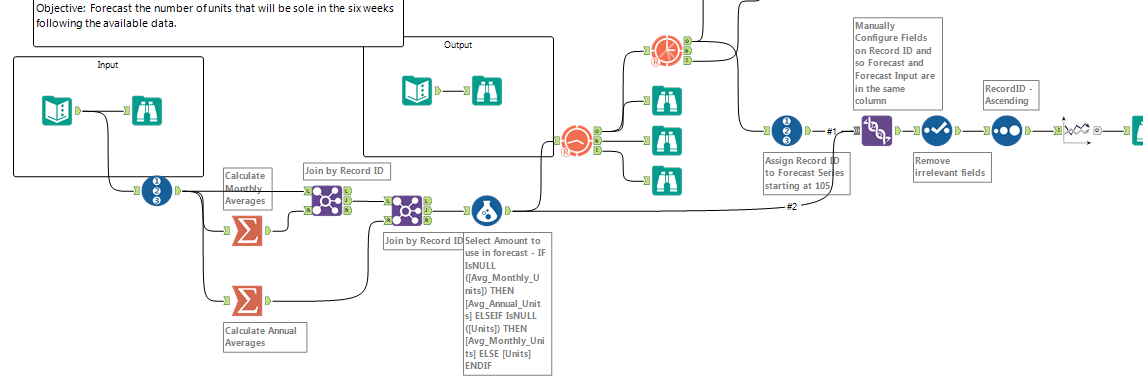

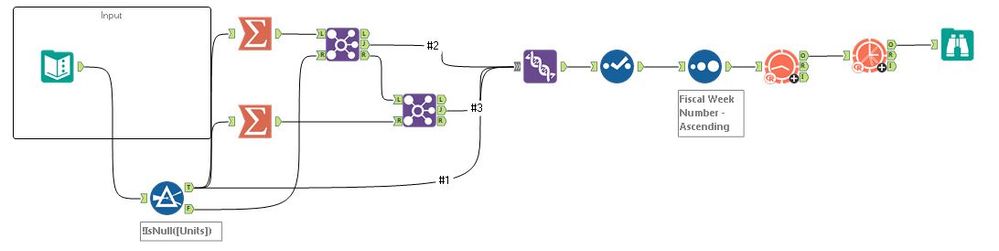

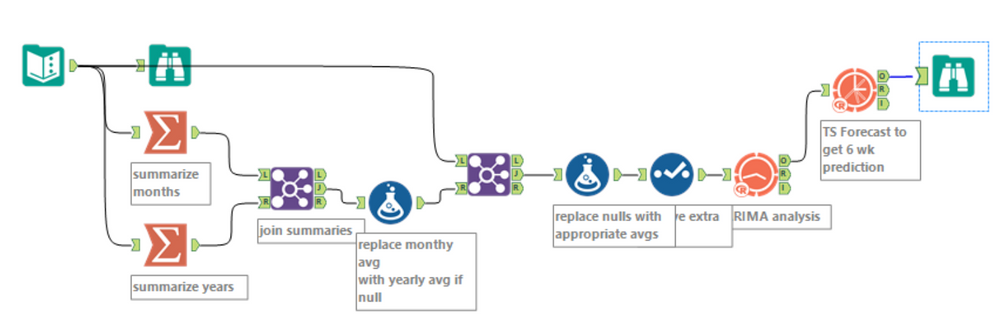

The source data contains weekly data for 2012 and 2013 details how many units have been moved. Some of the data, however, is populated with NULL values. For the NULL values, please assign the monthly average. If the monthly average is also NULL, assign the annual average.

Objective: Forecast the number of units that will be sold in the six weeks following the available data.

Have fun!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

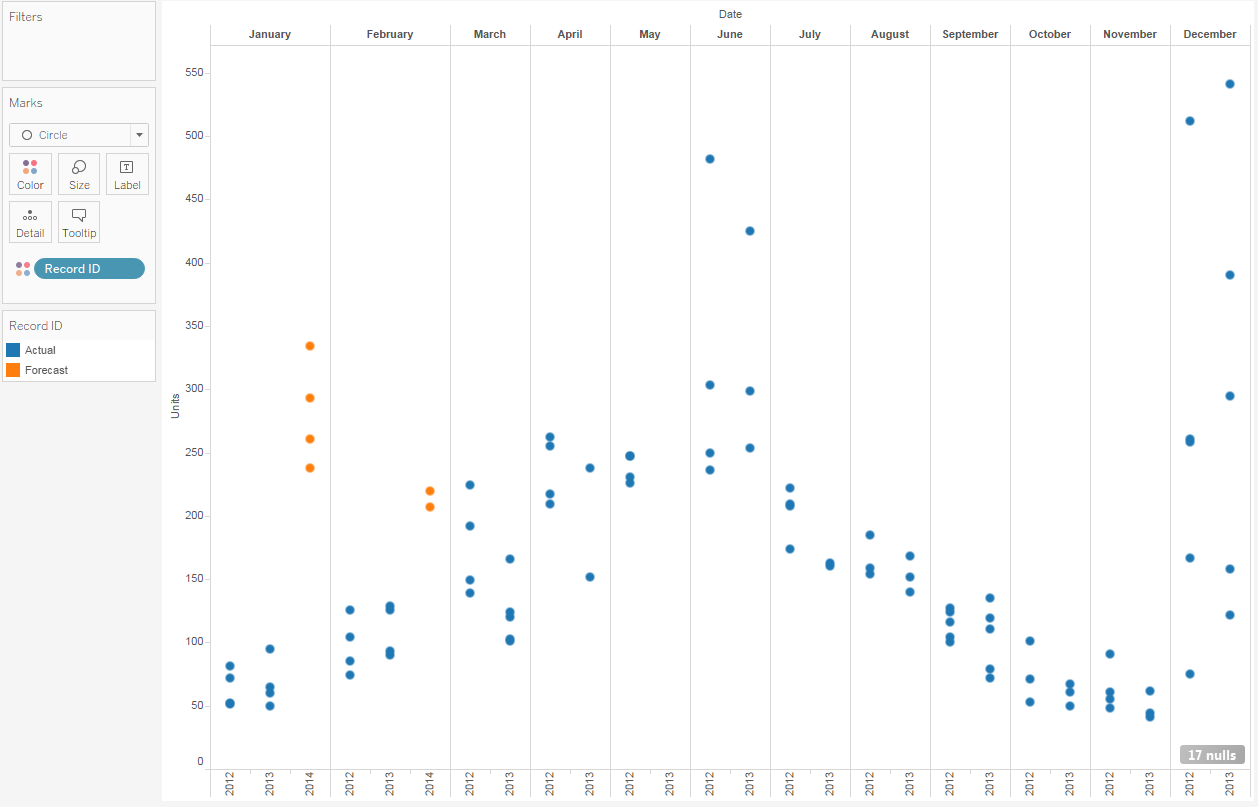

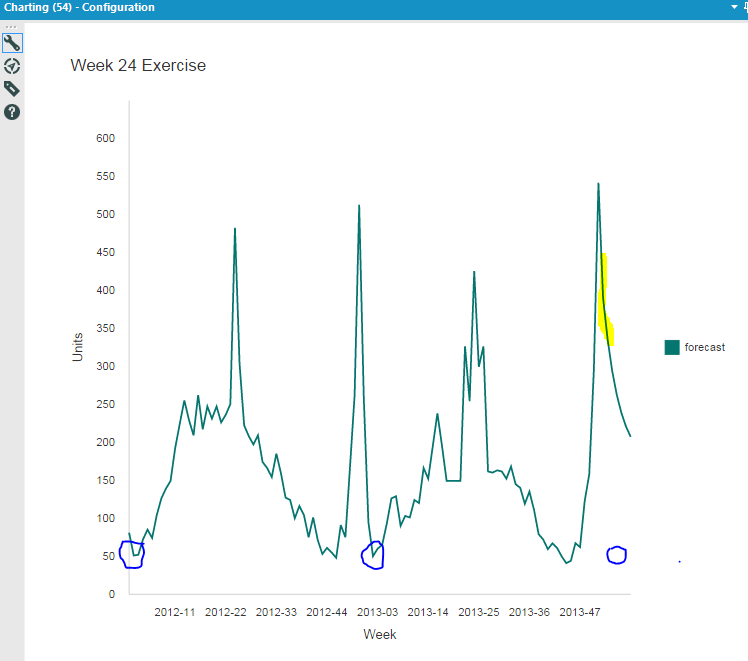

I arrived at the same answer, but I'm not sure it's the best answer. Based on the historical data, the forecast doesn't adjust for the drop off in sales each January. How would we configure the tool for a better answer? See spoilers below have the workflow plus what I came up when I exported to Tableau.

I added the the forecast back to the original data and came up with this chart in Alteryx. See how forecast did not adjust to prior January trends.

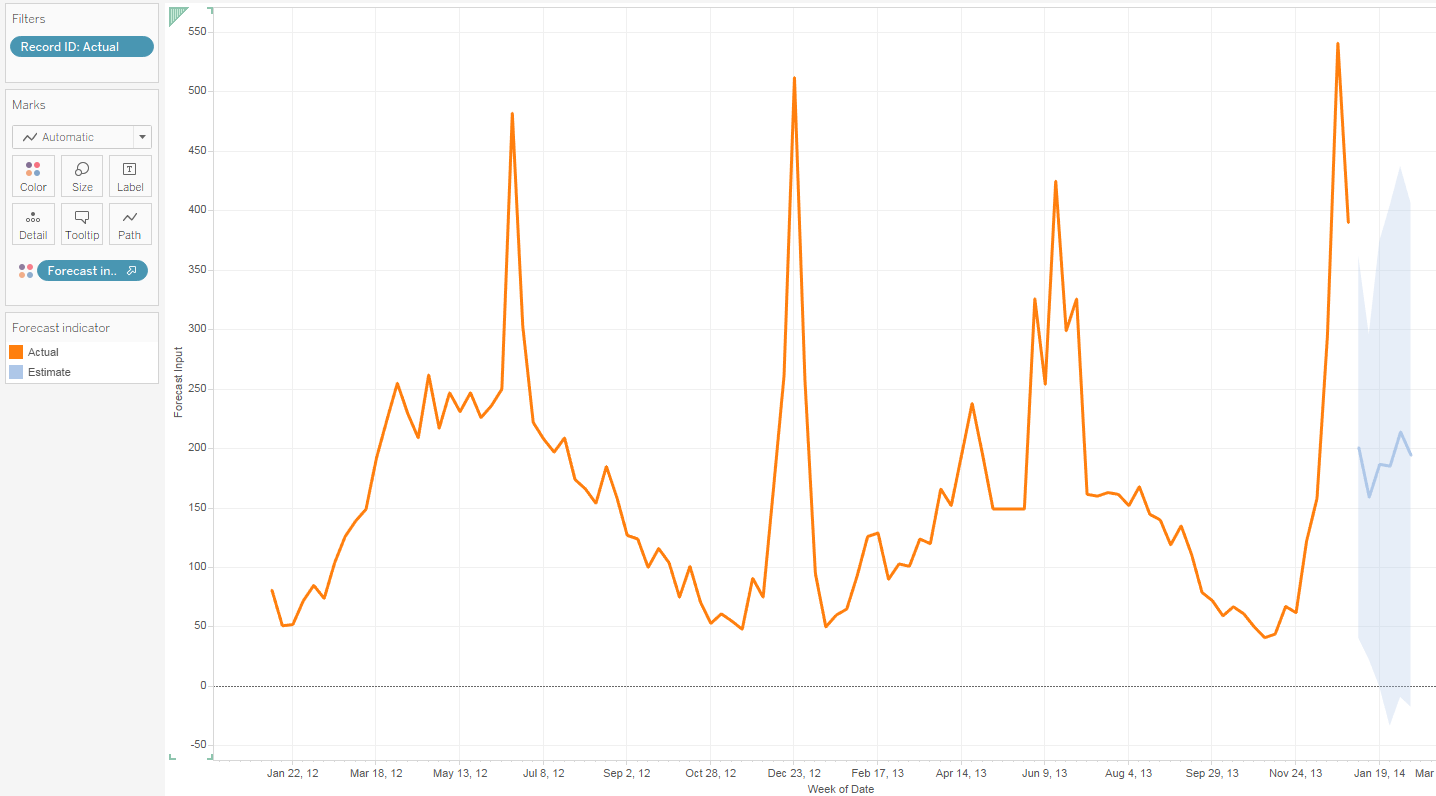

This is the data presented in Tableua plus the forecast solution that Tableau provided using the default settings.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

My solution! I like these Time Series predictive tools, pretty intuitive (especially for someone who never uses predictive analytics!)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

I've not really explored the TS Tools (except TS Filler), I ended up with the same solution as other however, my forecast scores are correct but the confidence scores are slightly out and I can't see why?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

-

Advanced

302 -

Apps

27 -

Basic

158 -

Calgary

1 -

Core

157 -

Data Analysis

185 -

Data Cleansing

5 -

Data Investigation

7 -

Data Parsing

14 -

Data Preparation

238 -

Developer

36 -

Difficult

87 -

Expert

16 -

Foundation

13 -

Interface

39 -

Intermediate

268 -

Join

211 -

Macros

62 -

Parse

141 -

Predictive

20 -

Predictive Analysis

14 -

Preparation

272 -

Reporting

55 -

Reporting and Visualization

16 -

Spatial

60 -

Spatial Analysis

52 -

Time Series

1 -

Transform

227

- « Previous

- Next »