Alteryx Designer Desktop Discussions

Find answers, ask questions, and share expertise about Alteryx Designer Desktop and Intelligence Suite.- Community

- :

- Community

- :

- Participate

- :

- Discussions

- :

- Designer Desktop

- :

- Re: MERGING SEVERAL TABS TOGETHER - 100+

MERGING SEVERAL TABS TOGETHER - 100+

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Hi All,

I am attaching a file that has around 5 tabs as an example to merge. I have tried using Dynamic Input and have had success in merging 20-30 tabs together.

However, just wanted to see how can I merge more than 100 tabs all together? Sometimes the Dynamic Input gives a Schema error.

Any solution would be appreciated. Thanks!

Solved! Go to Solution.

- Labels:

-

Apps

-

Batch Macro

-

Best Practices

-

Bug

-

Common Use Cases

-

Connectors

-

Custom Tools

-

Database Connection

-

Datasets

-

Developer

-

Documentation

-

Dynamic Processing

-

Error Message

-

Fuzzy Match

-

Help

-

In Database

-

Input

-

Iterative Macro

-

Join

-

Machine Learning

-

Macros

-

Output

-

Parse

-

Power BI

-

Predictive Analysis

-

Preparation

-

Regex

-

Reporting

-

Scheduler

-

Server

-

Settings

-

Transformation

-

Workflow

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Have you looked into this post?

I also sometimes use VBA to do things like splitting tabs to separate files, renaming tabs or combining tabs of the same schema to simplify multiple tab management.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Hi @iamviraj13

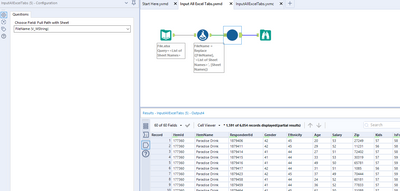

Here is how you can do it.

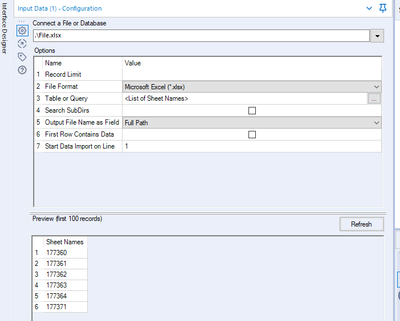

You'll first want to read in your Excel File to include the Full Path as a field and also only read in a list of sheet names.

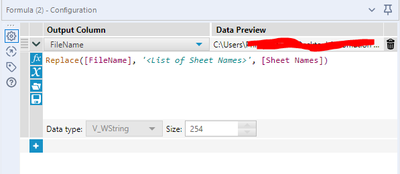

The use a Formula tool to create updated FileNames that include the full path and the sheet name.

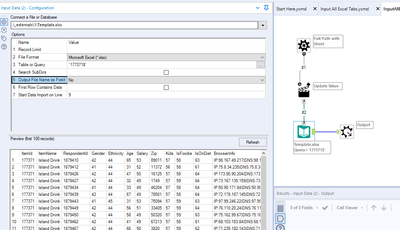

This will then be fed into a batch macro that will read in and combine all the tabs.

The macro itself is configured for the needs of the sample file you provided, so the template it uses starts the data import on row 9 but can be changed if needed. You can also include the Full Path or File Name as a field, so you know which tab the data is coming from.

Attached is a zipped copy of the sample workflow and the macro for you to try out.

Let me know if this works for you.

Cheers!

Phil

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Great macro solution @Maskell_Rascal ! I am definitely going to be using this myself as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Thanks, @Maskell_Rascal for the detailed explanation.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Ty

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Ty

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Ty

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Ty

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

I have multiple excel files each having singe sheet named as MOD_IVA. All these excels have similar columns, some have extra unique columns too. I want to collate all these columns into on single excel file. How do I do it. Have tried macro batch input but getting an error of different schema.

-

Academy

5 -

ADAPT

2 -

Adobe

201 -

Advent of Code

2 -

Alias Manager

76 -

Alteryx Copilot

19 -

Alteryx Designer

7 -

Alteryx Editions

56 -

Alteryx Practice

19 -

Amazon S3

147 -

AMP Engine

246 -

Announcement

1 -

API

1,197 -

App Builder

113 -

Apps

1,353 -

Assets | Wealth Management

1 -

Basic Creator

10 -

Batch Macro

1,524 -

Behavior Analysis

243 -

Best Practices

2,674 -

Bug

712 -

Bugs & Issues

1 -

Calgary

67 -

CASS

53 -

Chained App

265 -

Common Use Cases

3,796 -

Community

24 -

Computer Vision

82 -

Connectors

1,411 -

Conversation Starter

3 -

COVID-19

1 -

Custom Formula Function

1 -

Custom Tools

1,931 -

Data

1 -

Data Challenge

9 -

Data Investigation

3,467 -

Data Science

2 -

Database Connection

2,197 -

Datasets

5,185 -

Date Time

3,214 -

Demographic Analysis

184 -

Designer Cloud

722 -

Developer

4,332 -

Developer Tools

3,505 -

Documentation

522 -

Download

1,024 -

Dynamic Processing

2,911 -

Email

921 -

Engine

145 -

Error Message

2,233 -

Events

193 -

Expression

1,862 -

Financial Services

1 -

Full Creator

1 -

Fun

2 -

Fuzzy Match

707 -

Gallery

657 -

GenAI Tools

1 -

General

1 -

Google Analytics

156 -

Help

4,680 -

In Database

961 -

Input

4,261 -

Installation

352 -

Interface Tools

1,889 -

Iterative Macro

1,082 -

Join

1,944 -

Licensing

243 -

Location Optimizer

61 -

Machine Learning

257 -

Macros

2,833 -

Marketo

12 -

Marketplace

22 -

MongoDB

83 -

Off-Topic

4 -

Optimization

745 -

Output

5,211 -

Parse

2,314 -

Power BI

224 -

Predictive Analysis

934 -

Preparation

5,133 -

Prescriptive Analytics

205 -

Professional (Edition)

2 -

Publish

256 -

Python

846 -

Qlik

39 -

Question

1 -

Questions

1 -

R Tool

477 -

Regex

2,330 -

Reporting

2,418 -

Resource

1 -

Run Command

566 -

Salesforce

276 -

Scheduler

409 -

Search Feedback

3 -

Server

618 -

Settings

928 -

Setup & Configuration

3 -

Sharepoint

614 -

Spatial Analysis

595 -

Tableau

511 -

Tax & Audit

1 -

Text Mining

465 -

Thursday Thought

4 -

Time Series

428 -

Tips and Tricks

4,162 -

Topic of Interest

1,119 -

Transformation

3,694 -

Twitter

23 -

Udacity

84 -

Updates

1 -

Viewer

2 -

Workflow

9,884

- « Previous

- Next »