Alteryx Designer Desktop Discussions

Find answers, ask questions, and share expertise about Alteryx Designer Desktop and Intelligence Suite.- Community

- :

- Community

- :

- Participate

- :

- Discussions

- :

- Designer Desktop

- :

- Predictive analytics, ARIMA model with forecasting...

Predictive analytics, ARIMA model with forecasting for many programs

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

I'd like to use predictive modeling to identify which programs may lose money in the future. I have monthly data within the FY for hundreds of programs, in categories of actual revenue, actual margin, forecast revenue, forecast margin, etc. Each category is recorded per month, so for actual margin, I have values for January through October, actual revenue Jan - Oct., etc.

What I'd like to do is set up a process by which I run the analysis for all programs, then use the resulting forecast file to see which programs are forecasted to lose money. In the process attached, I filter for Actual Margin, fill any empty months, run the data through the ARIMA tool and then the forecast tool. This gives me usable data when my initial filter also filters by a single program, but meaningless data without the program filter.

Is there a way to run the forecast process iteratively to get results per program? Or, is there a whole better way to approach this?

Thank you!

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Hi @Kmassey

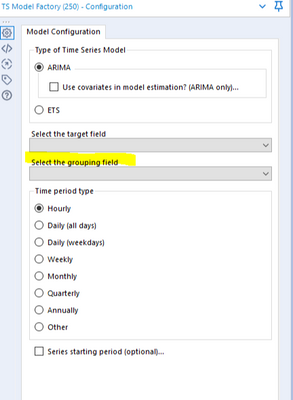

You can try the TS Model Factory tool available on the public gallery that allows grouping.

https://gallery.alteryx.com/#!app/TS-Model-Factory/5772af65aa690a1348cc6abf

This is how its config window looks like. Hope this helps. Cheers!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Wow, looks promising, but totally different from what I've used in Alteryx so far. Is there a knowledge base you can point me to to interpret this macro? I've not used macros before.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Hi @Kmassey

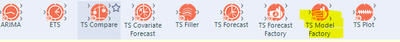

Once you download it, it will appear in the "Time Series" suite next to the other Time Series building blocks you are currently using. See below:

You will simply drag it, drop it into the canvas and configure it the same way you would do with other building blocks.

This is also the link to the Help page that talks more about this tool https://help.alteryx.com/2020.2/TS_Model_Factory.htm

Cheers!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Thanks, it took a bit of gyrating to get the tool loaded and available for use in Designer, something to do with location of the downloaded file in the Alteryx macros folder.

When I run the tool, I get the "insufficient records to run an ARIMA model" message. My date field is correctly formatted, but my data are typically good for only one FY. If I duplicate the FY data so that I have 2 year's worth, the model runs without error, but results and forecast are suspect, right? For my need to forecast values based on 12 months of data, is there a better approach or tool?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Hi @Kmassey,

ARIMA combines autoregressive processes with the moving average, for the approach the number of available periods is really very small, especially when it comes to detecting a correlation with values from previous periods. I think increasing the number of periods by copying them does not lead to useful results here. Maybe it would be better to simply work with a moving average? What do you think?

Best,

Roland

-

Academy

6 -

ADAPT

2 -

Adobe

204 -

Advent of Code

3 -

Alias Manager

78 -

Alteryx Copilot

26 -

Alteryx Designer

7 -

Alteryx Editions

95 -

Alteryx Practice

20 -

Amazon S3

149 -

AMP Engine

252 -

Announcement

1 -

API

1,208 -

App Builder

116 -

Apps

1,360 -

Assets | Wealth Management

1 -

Basic Creator

15 -

Batch Macro

1,559 -

Behavior Analysis

246 -

Best Practices

2,695 -

Bug

719 -

Bugs & Issues

1 -

Calgary

67 -

CASS

53 -

Chained App

268 -

Common Use Cases

3,825 -

Community

26 -

Computer Vision

86 -

Connectors

1,426 -

Conversation Starter

3 -

COVID-19

1 -

Custom Formula Function

1 -

Custom Tools

1,938 -

Data

1 -

Data Challenge

10 -

Data Investigation

3,487 -

Data Science

3 -

Database Connection

2,220 -

Datasets

5,222 -

Date Time

3,227 -

Demographic Analysis

186 -

Designer Cloud

742 -

Developer

4,372 -

Developer Tools

3,530 -

Documentation

527 -

Download

1,037 -

Dynamic Processing

2,939 -

Email

928 -

Engine

145 -

Enterprise (Edition)

1 -

Error Message

2,258 -

Events

198 -

Expression

1,868 -

Financial Services

1 -

Full Creator

2 -

Fun

2 -

Fuzzy Match

712 -

Gallery

666 -

GenAI Tools

3 -

General

2 -

Google Analytics

155 -

Help

4,708 -

In Database

966 -

Input

4,293 -

Installation

361 -

Interface Tools

1,901 -

Iterative Macro

1,094 -

Join

1,958 -

Licensing

252 -

Location Optimizer

60 -

Machine Learning

260 -

Macros

2,864 -

Marketo

12 -

Marketplace

23 -

MongoDB

82 -

Off-Topic

5 -

Optimization

751 -

Output

5,255 -

Parse

2,328 -

Power BI

228 -

Predictive Analysis

937 -

Preparation

5,169 -

Prescriptive Analytics

206 -

Professional (Edition)

4 -

Publish

257 -

Python

855 -

Qlik

39 -

Question

1 -

Questions

2 -

R Tool

476 -

Regex

2,339 -

Reporting

2,434 -

Resource

1 -

Run Command

575 -

Salesforce

277 -

Scheduler

411 -

Search Feedback

3 -

Server

630 -

Settings

935 -

Setup & Configuration

3 -

Sharepoint

627 -

Spatial Analysis

599 -

Starter (Edition)

1 -

Tableau

512 -

Tax & Audit

1 -

Text Mining

468 -

Thursday Thought

4 -

Time Series

431 -

Tips and Tricks

4,187 -

Topic of Interest

1,126 -

Transformation

3,730 -

Twitter

23 -

Udacity

84 -

Updates

1 -

Viewer

3 -

Workflow

9,980

- « Previous

- Next »