Weekly Challenges

Solve the challenge, share your solution and summit the ranks of our Community!Also available in | Français | Português | Español | 日本語

IDEAS WANTED

Want to get involved? We're always looking for ideas and content for Weekly Challenges.

SUBMIT YOUR IDEA- Community

- :

- Community

- :

- Learn

- :

- Academy

- :

- Challenges & Quests

- :

- Weekly Challenges

- :

- Challenge #362: Capital Gains Tax when Selling a H...

Challenge #362: Capital Gains Tax when Selling a Home

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

A solution to last week’s challenge can be found here.

To solve this week’s challenge, use Designer Desktop or Designer Cloud Trifacta Classic.

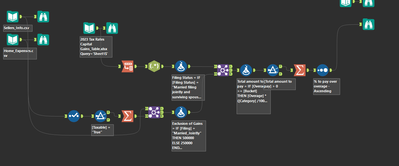

If you are currently selling your home, you may not be happy to learn that capital gains (profit from the sale of the home) are taxable in the United States. One way to reduce the amount of capital gains taxes you pay is to use deductions.

For this challenge, we will use two possible deductions, the Exclusion of Gain (you may qualify to exclude up to $250,000 of the capital gain from your income as a single filer, or up to $500,000 of that gain if you file a joint return with your spouse); and Capital Improvements (when home sale profits exceed the exclusion of gain threshold, consider deducting any capital improvements you made to the home while you owned it).

Your challenge is to answer two questions:

- Identify which home sellers will have to pay taxes on the profit made from the sale of their home.

- Determine how much those sellers have to pay.

Use the information below to calculate and determine who should pay taxes.

DISCLAIMER: This challenge is meant for educational purposes only and is not intended to be construed as financial, tax, or legal advice.

- Labels:

-

Advanced

-

Data Preparation

-

Intermediate

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

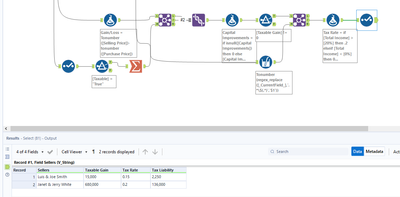

My Solution. But would the "overage" not only be the part of the "capital gain" which is above the "exclusion of gains" value?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

Watch that overage!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

I don't think the gain exclusion is included in the solution (though speaking as a CPA there's not enough information to say if it technically should be 😂).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

@Luke_C I thought the same thing at first after reading just the directions. If you look at the image included in the workflow, though, it suggests a bit of a different calculation.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

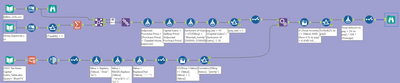

Here's my solution. I tested my multi-row formula that allocates the percentage to pay with varying amounts. I believe that isn't the intention of the challenge, but it is a bit more dynamic as a result.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Notify Moderator

-

Advanced

274 -

Apps

24 -

Basic

128 -

Calgary

1 -

Core

112 -

Data Analysis

170 -

Data Cleansing

4 -

Data Investigation

7 -

Data Parsing

9 -

Data Preparation

195 -

Developer

35 -

Difficult

70 -

Expert

14 -

Foundation

13 -

Interface

39 -

Intermediate

237 -

Join

206 -

Macros

53 -

Parse

138 -

Predictive

20 -

Predictive Analysis

12 -

Preparation

271 -

Reporting

53 -

Reporting and Visualization

17 -

Spatial

60 -

Spatial Analysis

49 -

Time Series

1 -

Transform

214

- « Previous

- Next »